State of Independent Work: Insights From 1000+ Independent Workers

Today, the independent economy offers 68 million individuals new opportunities to work on their own terms.

From freelancers and consultants to gig and on-call workers, independent workers have the ability to pursue what they’re passionate about, create their own schedule, and increase their earnings potential — aspects of their work life that may have been previously curtailed by traditional W-2 employment. The independent economy is only going to grow as more apps and platforms facilitate ways to work independently, as more companies turn to freelancers and contractors, and as more individuals look outside the walls of a workplace for new career avenues.

But is the life of an independent worker smooth sailing? Or are choppy waters making the journey difficult for those already out to sea, and keeping others from ever leaving shore?

At the Independent Economy Council, we desire to learn more about the successes and joys independent workers experience, but also their challenges and pain points to discover where resources and tools can fill in the gaps. In March 2022, we surveyed 1000 independent workers to learn more about what motivated them to join the independent economy, their financial challenges, how they’re using the apps and platforms available to them, and if they would ever return to W-2 work. Our findings were both expected and surprising, and will provide strategies not just for independent workers going forward, but for the companies that serve and pay them.

The Independent Economy Council was founded in 2021 by a community of workers, advocates, entrepreneurs, and researchers in order to make American workers more economically secure by making independent work more viable for everyone.

We believe this research will help us get there.

Key Findings

Here are some of the insights we uncovered regarding the world of independent work:

Having a flexible schedule is the biggest motivation. Other motivations to becoming an independent worker include being their own boss, control over their financial future, and being able to pursue work they’re passionate about.

63% earn more as an independent worker. The majority are earning more than they did in traditional W-2 employment. They’re also mostly working 30 to 40 hours per week, and have two or three sources of income.

57% would return to W-2 work for a price. Better pay, business failure, and life event changes requiring something more stable would convince them to return to traditional employment. However, 43% say that no amount of money would convince them to return to W-2 work.

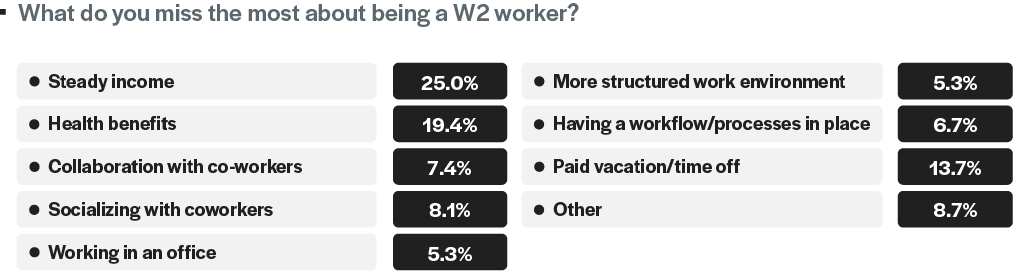

They miss a steady income from W-2 work the most. They also miss having health benefits, paid vacation and time off, and socializing and collaborating with coworkers.

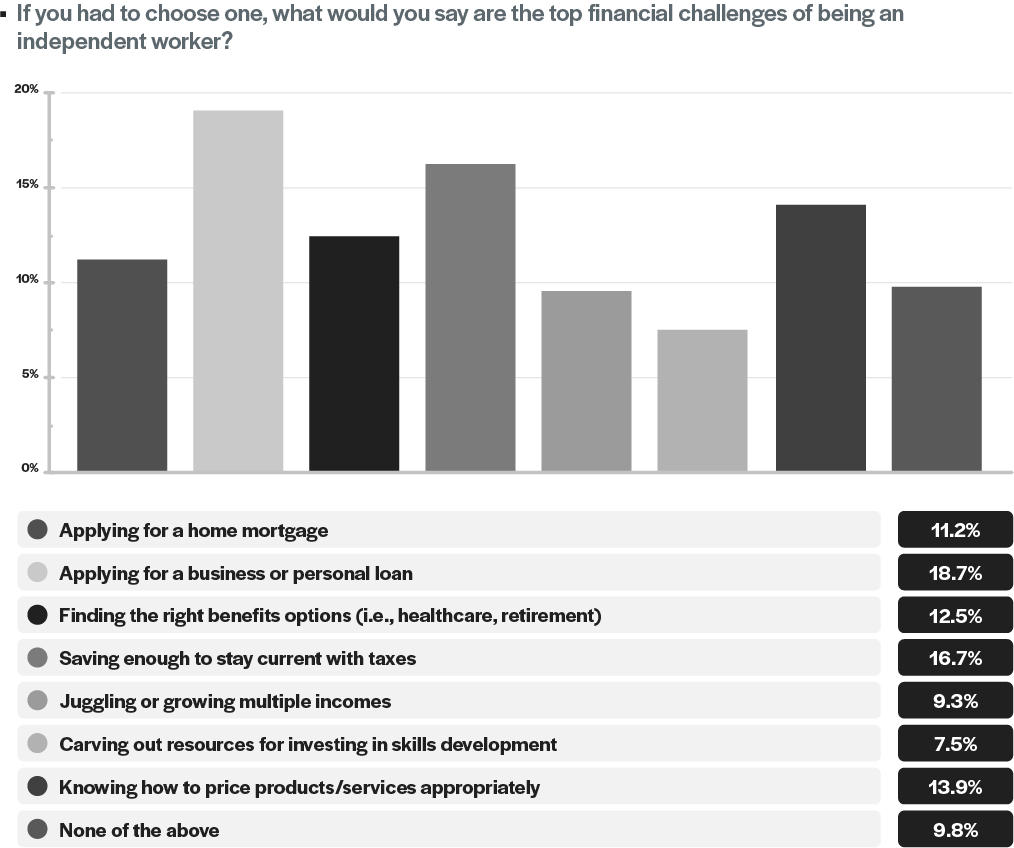

Saving enough for taxes is their top concern. When it comes to financial concerns, they’re worried about saving enough to cover their tax obligations. They’re also worried about applying for a business or personal loan, knowing how to price products or services appropriately, and finding the right benefits options.

49% need a platform in order to generate their income. While 31% acquire their customers or clients directly and 20% acquire directly while also using platforms, half of those surveyed say they couldn’t earn the income they do without using a platform.

Before quitting their full-time job, they would have saved more money. They also would have had a business or growth plan in place before the transition and had more customers lined up.

Table of Contents

Part 1: Benchmarks

Part 2: Journey to Becoming an Independent Worker

Part 3: The Motivations and Challenges of Life as an Independent Worker

Part 4: Platforms

Part 5: Outlook on Independent Work

Part 6: Expert Collaboration

Part 7: Takeaways

Who We Surveyed: Methodology and Participant Demographics

In order to provide greater context around these findings, here are more details on who we surveyed and the methodology used. Starting on March 14, 2022, we surveyed 1011 workers in the US who are self-employed and earn the majority of their income from work as an independent worker (1099 income). The survey was conducted online via Pollfish using organic sampling. Learn more about the Pollfish methodology here.

Summary

Now, with context around who our respondents were — majority female, mostly Millennials, and who work miscellaneous independent work — let's take a closer look at what we uncovered.

Part 1: Benchmarks

Independent workers are a varied group. From gig work to freelance contracting to running their own merchant shops, there’s no one common profile of an independent worker. Still, we wanted to establish some benchmarks and basic data to better understand who our respondents are, how much they’re making, and how often they’re working.

40% have two or three sources of income

Because independent work is flexible, with the ability to take on multiple projects or gigs at once, we wanted to know how many different things our respondents are doing to earn money, both actively and through passive income streams like selling books, webinars, workshops, or investing? The largest segment of our respondents (39.5%) have had two or three revenue streams over the past year, followed by 31.4% with only one revenue stream. 15.4% have had four to five, and 13.8% have more than five.

43% made $51,000 or more last year from independent work

Now that they’re on their own earning income in their own way, how much are they making? The largest segment (36%) made $35,000 or less over the past year from their independent work. The next largest segment (20.9%) made between $36,000 and $50,000, and the third largest segment (13.2%) made between $51,000 and $75,000.

Broken down, 56.9% made $50,000 or less, and 43.1% made $51,000 or more over the past year. Additionally, those making $150,000 or more tend to have five or more income streams.

46% are working 30 to 40 hours per week

Now that they’re able to create the schedule they want, how many hours are they actually working per week? The largest segments of our respondents are working 40 hours per week (23.5%) or 30 hours per week (22.3%) on independent contractor, gig, or other 1099 work. Others work 10 hours per week (11.4%), 20 hours per week (18%), 50 hours per week (13.9%), and 60+ hours per week (11%).

Summary

Independent workers are busy. 40% of our respondents have two to three income streams through which they make their earnings, yet 29% have four or more. They’re also putting in full-time hours, with 22% working 30 hours a week and 24% working 40 hours per week. While a little over half (57%) made up to $50,000 last year, 20% made over $100,000 from their independent work.

Part 2: Journey to Becoming an Independent Worker

You often hear the story: “I left my 9-to-5 to be my own boss.” And it’s a story we’re hearing more often these days as individuals make the transition from traditional employment to self-employment. But how did they get there? Did they simply quit and take the leap, or slowly build up clients on the side? Would they have done anything differently if they could go back now? Here’s what we uncovered about the journey to becoming an independent worker.

33% have been independent workers for one to three years, and 22% have six or more years’ experience

The largest segment of our respondents have been generating income from independent work for one to three years (32.6%) — meaning they became independent workers during the pandemic — followed by 22.3% who have been independent workers for six or more years. Other respondents have been independent workers for less than 6 months (10.6%), for six to eleven months (15.8%), and for four to six years (18.7%).

57% starting earning money on the side before quitting their full-time job

Common sense suggests that you slowly build up a client base on the side, making a slow transition to independent work, yet many take that leap all at once. For our respondents, 57.4% replied that they started earning money on the side from independent work before leaving their full-time job. 42.6% did not, and simply made the transition from one to the other.

Top Three Things Independent Workers Would’ve Done Differently Before Quitting

Making the transition to self-employment after working for a traditional employer can be a big and potentially complicated step. Our respondents say they would’ve done these things differently, knowing what they know now:

Have more money saved (35.7%): Before leaving their full-time position, over one-third of our respondents would have saved more money, most likely to buffer the loss in income while finding new clients and gaining experience. More savings could also help with tax obligations they might have been unprepared for.

Have a business or growth plan in place before the transition (19.1%): Next, many look back and realize they needed more planning before moving to independent work: setting goals for client acquisition, setting up a strategy for building a website and social media following, planning out how to pitch clients on various platforms, and more.

Have more customers lined up (18.6%): Respondents also say they should’ve built up their client or customer base a bit more before transitioning fully to independent work, ensuring more steady income and guaranteed work.

Other things they wish they had done differently include training themselves on the skills needed to be a successful independent worker (15.7%), and studying the industry or niche in which they would have liked to work in advance (10.9%).

35% are finding success without having gone to college or taken a skills course

Because the independent economy offers so many options for jobs and career growth, there’s less of a reliance on traditional education and career paths. We found that with our respondents, the largest segment is finding success without having gone to college or having taken a skills course (34.7%). 22.5% say that college helped them with their independent work, and 22% say a skills course helped them. Finally, for 20.9%, both college and a skills course helped them.

Independent work is a great option for those with non-traditional educational backgrounds. In digging further into those who responded that they neither went to college nor took a skills course, 58.4% earn more annually as an independent worker than as a W-2 worker. 67.8% made as much as $50,000 last year. Additionally, 49.6% say they don’t feel burned out with their work.

Summary

The journey to becoming an independent worker is different for everyone. 57% of respondents started their independent work journey on the side while they were still traditionally employed, and then transitioned into it as a primary way to earn their income. However, 43% didn’t, and simply made the switch.

However, those who did start earning money on the side before leaving their full-time job still say that the number one thing they would’ve done differently was to save up even more money before they quit. They also would’ve had a business or growth plan in place before moving to independent work, so they could have goals to focus on and a map to follow to hit those goals. They also would’ve liked to have had more clients or customers lined up before they switched, guaranteeing income and steady work after the transition.

One thing that hasn’t seemed to be a barrier to entry is having some college or taking a skills course. The largest segment of respondents said that they didn’t go to college or take a skills course, and that lack hasn’t hindered their success as an independent worker.

Part 3: The Motivations and Challenges of Life as an Independent Worker

With the ability to earn an income how they want, when they want, and where they want, the life of an independent worker may seem easy and joyous. But is it? Our respondents provided insights into what life as an independent worker is really like, including the motivations for doing so, how the money compares to traditional W-2 work, where they spend their time, their financial challenges, and more.

Top Motivations to Being an Independent Worker

There are many different reasons why someone decides to become an independent worker. Here are the top reasons from our group of respondents:

Flexible schedule (29.2%): The top motivator to being an independent worker is having a flexible schedule, and being able to work when and for how long they want to.

Be my own boss (27.1%): Next, independent workers are motivated by being their own boss, having autonomy in their work, and controlling the direction of their career.

Control over my financial future (12.4%): Next, independent workers are motivated by the ability to remove the salary ceiling in traditional employment, and be able to increase their earnings potential.

Pursue work I'm passionate about (12.2%): Independent work also gives individuals the ability to follow their passions in a way that may not be possible in a traditional work setting.

Work from anywhere (10.1%): Similarly to the flexible schedule above, independent workers are motivated by being able to work wherever they want, whether it be from their couch or across the world.

Spend more time with my family (9.1%): Finally, a portion of independent workers are motivated by their ability to spend more time with their loved ones.

When broken down by segments across generation, gender, and ethnicity, wanting a flexible schedule and being their own boss remained the top two motivations, though sometimes switched places. However, each segment had different motivations that came third:

Gen Z also wants to work from anywhere (the only segment who ranked that motivation as third).

Millennials want control over their financial future and want to pursue work they’re passionate about (tied).

Gen X also wants control over their financial future.

Female respondents want to pursue work they’re passionate about.

Male respondents want control over their financial future.

Respondents of color also want control over their financial future.

White respondents want to pursue work they’re passionate about.

63% earn more as an independent worker

Can independent workers really earn more outside of a traditional workplace? Actually, they can. 62.7% earn more annually as an independent worker than they did in their traditional W-2 job. However, 37.3% do not.

Of course, those who say that they earn more are mostly working 40 hours per week, and have two or three income streams. Those who say they don’t earn more are working 20 to 30 hours per week, with only one income stream.

They don’t feel burned out with independent work

Are they burned out with their work? Not particularly, as nearly half (48.2%) say they’re not burned out from their work, with an additional 33.5% saying they feel somewhat burned out. 18.3% say they’re very burned out with their work.

Of those who say they are not burned out, they’re mostly working 40 hours per week with two to three income streams — so, while very busy, they’re not feeling the strain or stress of what they do. Of those who are very burned out, they’re mostly working 30 hours per week with only one income stream.

Top Five Things Independent Workers Miss the Most from a Workplace

Being self-employed has its many benefits that allow for happier lifestyles, more flexibility in schedule, and better pay. But what’s lacking from the independent worker life that our respondents miss from being in their traditional jobs? Here are the top five things:

Steady income (24.1%): Being an independent worker means having to grow comfortable with varied or inconsistent pay — and the steady income is the biggest thing they miss from a traditional workplace.

Health benefits (17.9%): They also miss health benefits supplied through their employer, as independent workers need to pay out-of-pocket for health insurance and care — or go without.

Paid vacation and time off (13.1%): Because independent workers only get paid when they work and don’t get paid when they don’t, they miss having paid time off provided by their employer.

Socializing with coworkers (9.7%): Self-employed individuals often do highly autonomous work, from writing alone at a computer to delivering food alone in a car — and our respondents miss being around others and socializing.

Collaboration with coworkers (7.5%): Similarly, our respondents also miss the collaborative nature of their traditional workplaces and working in teams, as they don’t often have that option now.

Other things they miss include having workflows or processes in place (5.9%), a more structured work environment (5.2%), working in an office (5%), or other aspects (11.5%).

What’s interesting to note is that each segment (generational, gender, and ethnicity) ranks what they miss the most exactly the same — except for Gen Z. While Gen Z also misses having a steady income the most (18.6%), it’s a much lower percentage than other segments. They also miss having health benefits (15.1%), but they also miss collaborating with (12.1%) and socializing with coworkers (11.6%) to a higher extent than other segments. Finally, missing paid vacation and time off is much lower on the list for Gen Z (9.6%), meaning it’s not a big priority for them.

They’re spending the most time on delivering products and services

Independent workers don’t just perform the core of the duties and call it a day. They’re also their own accountants, marketers, business managers, and more. What are they spending most of their time on? The largest segment (27.9%) is spending the most time on delivering products and services to their customers or clients (which, considering that many are gig workers, may be their actual job instead of peripheral tasks). The next largest segment (19%) spends most of their time on marketing. They’re also spending their time on sales (13.7%), administrative tasks (11.8%), and finances (9.2%). 18.5% are also spending time on other tasks not listed here.

Top Five Financial Challenges

Because independent workers are also their own accountants and business managers, what are the top financial challenges they face?

Saving enough to stay current with taxes (17%): Because independent workers don’t have taxes automatically deducted from their paychecks like W-2 workers do, they have to calculate their own taxes and set that portion aside — which is their biggest challenge.

Applying for a business or personal loan (16.1%): Unfortunately, many banks are reluctant to work with self-employed individuals, even if their income is steady and more than they made being traditionally employed.

Knowing how to price products or services appropriately (14.5%): Another big challenge is setting a project or hourly rate for services, or knowing how to put value or worth on time, talent, and efforts. Unfortunately, many self-employed individuals price themselves too low when they first enter the market.

Finding the right benefits options (i.e., healthcare, retirement) (12.6%): Because independent workers no longer receive health insurance, retirement options, and other benefits through an employer, they have to find and pay for those benefits on their own.

Applying for a home mortgage (11.2%): Similar to above, many banks are unsure how to work with self-employed individuals, are reluctant to work with those with variable income, or won’t take any self-employed income into account at all during a mortgage application.

Independent workers are also challenged with juggling or growing multiple incomes (9.7%), carving out resources for investing in skills development (6.4%), or other things not listed (12.5%).

Unlike some of the above questions, which didn’t change based on further filtering, the answers here do change based on generation, gender, and ethnicity.

The biggest challenges for Gen X are applying for a business or personal loan (17.9%) and knowing how to price products or services appropriately (16.6%).

The biggest challenges for Millennials are saving enough to stay current with taxes (19.7%) and applying for a business or personal loan (16.6%).

The biggest challenges for Gen Z are finding the right benefits options (16.1%) and saving enough to stay current with taxes (15.6%).

The biggest challenges for male respondents are saving enough to stay current with taxes (19.6%) and knowing how to price products or services appropriately (15.6%).

The biggest challenges for female respondents are applying for a business or personal loan (17.3%) and saving enough to stay current with taxes (14.9%).

The biggest challenges for respondents of color are applying for a business or personal loan (18.2%) and saving enough to stay current with taxes (14.7%).

The biggest challenges for white respondents are saving enough to stay current with taxes (18.4%) and knowing how to price products or services appropriately (15.1%).

Summary

In a world of burned out employees, independent workers are pretty happy with their jobs and earning more money than they were in their W-2 employment. Part of that happiness may be attributed to the fact that they can have a flexible work schedule and be their own boss, the top two motivators for being self-employed. Having autonomy over your work/life balance, your ability to earn, and the direction of your career can certainly elevate quality of life.

However, despite 63% saying they earn more as an independent worker, they still have a number of financial concerns. They’re concerned with not having enough income set aside to pay their estimated quarterly taxes. They’re concerned that being an independent worker will unduly negatively impact their ability to apply for a loan or a mortgage. They’re concerned about being able to find and afford benefits. Finally, they’re concerned about being able to price their products or services correctly in order to provide them with a livable income. It’s worth noting that these financial concerns are not shared by traditionally employed W-2 workers, but are independent worker-specific.

Despite the benefits of self-employment, there are a few things independent workers miss from the workplace: Steady income, health benefits, paid vacation and time off, socializing with coworkers, and collaborating with coworkers.

But instead of accepting these things as sacrifices to being an independent worker, the question should be, How can independent workers find these things they’re missing while also being self-employed? How can they find steadier income, or learn how to generate steadier income? Why aren’t there more independent health insurance and other benefits options for independent workers? Is there a way to give independent workers paid time off? Are there venues like coworking spaces where independent workers can socialize with those who do the same thing, or collaborate on projects? It shouldn’t be an “either/or” situation, where independent workers have to sacrifice these perks, but should be a “both/and.”

Part 4: Platforms

Platforms and apps like Uber, Upwork, Grubhub, Shopify, TaskRabbit, and others have opened up new ways for individuals to get involved in the independent economy. They have not only lowered barriers to entry and access, but have created whole new industries that didn’t exist a decade ago. While many independent workers rely on these platforms for their income, many are still seeking out and finding customers and clients outside of these platforms. How often are independent workers using apps and platforms, and do they feel positively about the experience?

They’re both acquiring customers directly and using multiple platforms

The largest segment of respondents (31.3%) acquire their customers or clients directly. However, closely following are 30.9% who use multiple platforms to find customers or clients. 20.2% do both: they use platforms, and get customers and clients directly. Finally, 17.7% use one platform to get customers and clients.

They use multiple platforms, and mostly driving or delivery platforms

Whatever type of independent worker you are, there’s a platform for you. When it comes to the type of platforms they use to acquire customers, the largest segment (24.6%) use driving or delivery platforms like Uber or DoorDash to find clients. 17.6% are using professional marketplace platforms like Upwork, and 17.4% are using eCommerce platforms like Shopify. 11.8% are using task-focused platforms like TaskRabbit. Finally, 28.6% are using something other than the platforms listed above.

63% find the fees charged on the platforms fair

Platforms that cater to independent workers often charge fees for facilitating the transactions. 63.2% do believe that the fees platforms charge for their use is fair, especially considering that they may not be able to find clients or customers outside of those platforms. However, 36.8% do not find them fair.

53% say the platform they use has not increased its fee over the past year

52.7% report that the platforms they use have not increased their fees over the past year. 47.3% say they have increased their fees.

49% need apps and platforms to generate their income

How important are these platforms to independent workers when it comes to finding clients and generating income? 51.4% say they are able to generate their income without using a platform. However, 48.6% don’t believe they’d be able to generate the income they do without the platforms they use.

It’s no surprise that those who answered that they could not generate income outside of the platforms are mostly using driving and delivery platforms and eCommerce platforms — outside of which it’s nearly impossible to facilitate business independently.

Summary

Independent worker platforms have not only become a great entry for those looking to find new clients and customers quickly, like Upwork or Shopify. They’ve also created industries where transactions can only be facilitated on the app, like Uber and DoorDash. We found that our respondents are using both apps and platforms to find clients and customers, but also still find them themselves (this certainly depends on what kind of independent work one does).

When it comes to platforms, respondents are generally favorable. 63% find the fees charged by the platform fair, and ultimately, 49% believe they wouldn’t be able to generate income without the platform — meaning that apps and platforms play a necessary and needed role in the independent economy.

Part 5: Outlook on Independent Work

Once independent workers leave the traditional W-2 work world, they never look back and always want to be their own boss, right? Maybe not. While some of our respondents want to stay self-employed going forward, others articulated why they might return to traditional work, and how their future as self-employed individuals might change according to their circumstances.

57% would return to W-2 work for a price

43.2% say that no amount of money would convince them to return to W-2 work. However, 56.8% said that yes, there is a specific amount that would get them to return.

While male and female respondents were nearly even in their opinions on how no amount of money could convince them to return (female: 46.5%, male: 46.9%), there were differences in other segments. For Gen X, 48.6% said they wouldn’t return, while for Millennials, only 38.2% believed the same. For Gen Z, 46.7% said they wouldn’t return. For white respondents, 38.9% said they wouldn’t return. However, for respondents of color, 50.8% said they wouldn’t return, a much higher number than the rest — perhaps indicating that there are better and more accessible opportunities for people of color in the independent economy than in traditional workplaces.

50% plan to continue always earning their income as independent workers

49.7% say they plan to always earn the majority of their income from their self-employed work. However, 17.7% say they don’t plan to always earn the majority of their income from self-employed work, meaning they plan to return to W-2 work, or want to keep their options open. However, 32.6% are willing to return to W-2 depending on the opportunity.

Better pay would convince them to return

Is there any opportunity or price point that would get independent workers to return? 11.7% say nothing could get them to return to W-2 work again. However, the rest of our respondents had other reasons why they might return.

Better paying job (24%): If the salary number were right, they would be convinced to go back to traditional W-2 work.

If my business fails (12.9%): They would return as a last resort if they couldn’t make it as an independent worker.

Life events force me to have something more stable (12.2%): They would return if they suddenly needed stable income, benefits, or other guarantees of traditional employment.

More exciting job with more opportunity (12%): They would return if the right opportunity to use their skills and talents came along.

Career opportunities (11.4%): They would return if the position could advance their career further than independent work.

Need for specific perks (8.5%): They would return if they could have certain perks along with the position (like a flexible work arrangement).

Other (7.4%): They would return for other reasons not listed.

66% of parents or guardians hope their kids enter the independent workforce

Of the 53.6% of respondents who are a parent, caretaker, or guardian of a child or children, 65.5% said they hope their kids become independent workers, while 34.5% hope they follow a more traditional W-2 path.

Summary/Transition

What’s the outlook on independent workers, a group that is only expected to grow into the future? We saw throughout that money is a big concern for this group: they miss having a steady income, they’re concerned about saving enough for taxes, and they wished they had more money saved before they became self-employed. So, despite the big motivators of having a flexible schedule and being their own boss, it’s surprising — but also not surprising — to find that 57% of independent workers would return to W-2 if the price was right. We also found that 50% don’t necessarily plan to continue earning their income from independent work.

Why is that, when independent work gives more autonomy, less stress, and even more income than W-2 work? From the answers above to the question “What would make you become a W-2 worker again?” we see that for some, they’re looking at career opportunities and development, which, if that presents itself in the form of a W-2 position, they’ll take.

But we also get the sense from the above answers that, for many, independent work is an experiment. If their business fails or there’s a life event that happens, the sentiment isn’t that they’ll start another business or increase or diversify their client portfolio to give them more stability — they’ll just fall back to a W-2 position.

However, about half of our respondents seem to be committed to independent work. 43% say that no amount of money would convince them to return to W-2 work, and 50% plan to continue always earning their income as independent workers. Additionally, 66% of self-employed parents or guardians hope their kids enter the independent workforce too. Maybe they love the flexible hours or location options, maybe they love being their own boss and taking their career trajectory into their own hands, maybe they’ve found more opportunities without a college background, or maybe they’ve found a greater ability to earn income. Whatever they’ve found, they see it as better than the alternatives.

Part 6: What’s Next

To better understand what can be done to build a better future for independent workers, we asked several experts to answer the question:

How can we build a better future for independent workers?

"Freelancing almost always starts as a solo endeavor, but as one person, you quickly realize your limitations in the number of projects you can take on and the types of projects you’re able to tackle. With 95% of freelancers not breaking 6-figures and over half the workforce projected to be freelance by 2030, I believe we can build a better future for independents by helping them team up and unlock their earning potential. With better financial tools to help determine how much to charge the client, how to break down team budgets and manage their billings, teaming up is an opportunity to help freelancers compete with large agencies for better projects and bigger paychecks. With economic instability causing people to quit at all time highs and wages stagnating at all time lows, it’s more important than ever that we roll up our sleeves and end this race to the bottom, together."

— Rachel Renock, CEO and Co-founder of Wethos

“Independents are shaping the future of work. They want to pursue purposeful careers on their own terms and strive for self-made success over the status quo. Building a better future for independent workers requires leveraging all the tools at our disposal to mobilize and unify this rising category. I believe there is a massive opportunity to champion technology to enable their success, remove barriers to their growth, and equip them with the resources they need to thrive. At HoneyBook this means empowering independents with a better way to work and a platform that brings remarkable client experiences to life.”

— Oz Alon, CEO and Co-founder of HoneyBook

“Striking out on your own is liberating yet lonely. When I went full time as a professional photographer back in 2012, it became immediately apparent how deeply isolating independent work can be. Many of us work alone, from home, behind a computer most of the day—without the support that comes from being a part of a larger organization. In order to build a better future for independent workers, we need to prioritize access to community support and advocate collectively for benefits that enable us to thrive personally and professionally. The moment independents see themselves as a part of a larger collective, a unified coalition, and powerful economic force—we will have the ability to build a better future together.”

— Natalie Franke, Co-founder of Rising Tide + Head of Community at HoneyBook

“Access and infrastructure. Access to the financial services and technology required to build a stable living foundation and the infrastructure that allows for those financial services to fit into the modern work life scenarios of today’s workforce. With financial access and infrastructure independent workers will finally have a financial social safety net allowing them to build their financial futures with even more productivity and potency.”

— Craig Lewis, Founder & CEO at Gig Wage

Part 7: Takeaways

Independent workers are finding great opportunities in the independent economy to do work they’re passionate about, be their own boss, create their own schedule, and earn more than they did in traditional employment. But there are challenges they face daily, like ensuring a steady income, saving up enough for taxes, and finding health insurance and other benefits. These deterrents may even be enough to send them back to traditional employment.

However, there are plenty of ways for companies who serve and pay independent workers to step in and help alleviate these burdens, and to help build the independent economy. Here are a few takeaways to consider:

Embrace independent workers, but recognize their uniqueness

Independent workers are passionate, engaged (as evidenced from their lower rate of burnout), and looking for customers and clients to serve with their talents, products, and services. Companies looking to hire independent workers should embrace the skills and autonomy that independent workers bring — and companies looking to fill in gaps with freelancers or contractors will be pleasantly surprised by the quality of talent they find. But they should also respect the motivations (as seen above) for why independent workers do what they do, and give independent workers the latitude to create their own schedule and work with them collaboratively as colleagues and peers — and not to box them in.

Help address their financial concerns

As we found throughout, independent workers are concerned about their finances: whether they have enough, whether they’re earning enough, and whether they’re saving enough. Companies who serve and pay independent workers, especially through apps and platforms, are in a unique position to provide features that can help.

Considering that the number one financial concern from respondents is staying current with their taxes, companies that pay independent workers can offer options for tax withholding at payout. This not only takes the burden off of independent workers to have to calculate and put aside a portion of their income themselves, it can ensure that the right percentage is being held aside and paid into their estimated taxes.

Another top concern of independent workers is finding the right health insurance, retirement options, and other benefits that independent workers have to find and pay for on their own. However, companies who hire independent workers should consider providing those benefits to them. Not only will it fill a big necessity for independent workers and ease the strain of finding benefits on their own, offering benefits will be a draw for independent worker talent.

Build more platforms for them

Not all independent worker apps and platforms are created equal. Some types of independent workers, like freelancers, contractors, and on-call workers, can find clients on their own in addition to using apps and platforms. But for half of those surveyed (49%), they can only earn their income through apps and platforms. Consider that the entire rideshare industry, third-party food delivery industry, and even the eCommerce industry wouldn’t exist without apps and platforms to facilitate the transactions. So, another way to build the independent economy is to build more apps and platforms that can facilitate new ways of working. Maybe the next new industry is waiting to be created.

Fill in the gaps on what they miss from traditional work

One of the questions we asked was what our respondents missed the most about a traditional workplace, not as a way to make a point about what they’re missing out on, but to make a point about what needs to be added to the independent economy to make workers more satisfied.

One of the things they missed the most was health benefits, which presents a great opportunity for companies who hire and serve independent workers to fill in that gap and offer health benefits to independent workers. Additionally, considering that independent workers only get paid when they work, they miss paid vacation and paid time off. This is another benefit companies that hire independent workers can offer as well, and would not only be a great and generous option, but would also be a draw to getting top talent.

Another thing they missed was socializing and collaborating with coworkers. While many independent workers tend to be more autonomous in their contributions, can companies who hire independent workers offer more collaboration with their teams? While independent workers may be contracted differently than W-2 workers, they’re still contributing to the team’s success. Why not offer the ability to connect and collaborate if independent workers want it?

More independent worker-to-worker education and support

The number one thing independent workers missed was a steady income. While we could encourage companies who hire independent workers to pay more and give more hours, the onus of knowing how to get steady income falls to other independent workers who have been doing this for a while to educate newcomers in the space. While resources for independent workers are growing every day, there’s still a lot of confusion over how to transition to being self-employed successfully and sustainably. (And this kind of intra-industry education and support is one of the goals of the Independent Economy Council.)

There’s a need for education around what needs to be in place before moving to independent work (as we saw above in what our respondents would’ve done differently before leaving), as well as how to navigate finding health insurance, applying for loans as an independent worker, and knowing how to price products and services correctly (the top financial concerns above).

There’s also a need for education around how to make independent work sustainable for the long-term, and not just an experiment that can simply be abandoned to return to traditional W-2 employment. Growing the independent economy actually means that independent workers stay independent workers, and what we found above is that they might not have the resources that get them to stick around.

The Future of the Independent Economy

The future trajectory of the independent economy is already established, and will continue to grow — but only if companies who serve and pay independent workers commitment to understanding their needs and pain points and create tools and resources to solve those pain points.

Will you be part of building the future of the independent economy?